Top 8 questions on SFDR answered

Who's affected, what are the most common challenges, and how to align? Here are the answers to all the burning questions you're still trying to figure out on SFDR compliance.

This blog is based upon our latest webinar "SFDR: How investors can meet the regulatory requirements." Watch it for free here:

Published: February 2023

The hot concept of the Sustainable Finance Disclosure Regulation (SFDR) can be somewhat hard to grasp.

But as the SFDR's first mandatory reporting deadline is just around the corner (30th of June, 2023 – mark your calendars!), it's high time to set it straight.

That is why we invited Jillian C. Kirn, Sustainability and Compliance Advisor at Climate Change Counsel, to join our webinar SFDR: How investors can meet the regulatory requirements and help clear out some of the trickiest questions regarding the SFDR.

Did you miss the webinar? Don’t worry. You can still watch the on-demand version here.

Who is Jillian C. Kirn?

Jillian C. Kirn is an Environmental Attorney & an ESG, and Climate Change Strategist who currently works as a Sustainability and Compliance Advisor at Climate Change Counsel, the Stockholm-based think-and-do-tank with a mission to mobilize the law and lawyers for climate action.

1. What is the SFDR?

The SFDR is an EU regulation that imposes mandatory environmental, social, and governmental (ESG) disclosure obligations on Financial Market Participants (FMPs).

The regulation aims to improve the transparency in the market for sustainable investment products, mitigate greenwashing, and increase transparency around sustainability claims made by FMPs.

2. Who is affected by the SFDR?

The SFDR applies to FMPs with more than 500 employees, such as investment firms, pension funds, asset managers, insurance companies, banks, and venture capital funds.

FMPs with less than 500 employees are not obliged to comply with the SFDR, but they must explain why they are not complying. Despite having the explain option, Jillian C. Kirn still recommends that all FMPs comply with the SFDR – as it will most likely become the global baseline for ESG disclosures.

So, what are the perks of complying? Well, most of the benefits of complying with SFDR's disclosure requirements – including attracting investor, avoiding being accused of greenwashing, and staying relevant in a rapidly-changing market – is relevant to FMPs of all sizes.

What are the benefits of complying with the SFDR?

There are plenty of benefits from complying with the SFDR's disclosure requirements – regardless of whether you're in-scope or not. Some of them include:- Attract investors;

Avoid being accused of greenwashing; - Staying relevant in a rapidly-changing market

3. What happens if you are not compliant with the SFDR?

In its current state, the SFDR has no direct penalties for non-compliance. Instead, it will be up to each member country to oversee and ensure that FMPs comply. According to Jillian C. Kirn, the regulators probably will accept the best efforts at first – but penalties and other enforcement measures will most likely evolve as the regulation develops over time.And remember, although there are no direct legal penalties, non-compliance may lead to public scrutiny, resulting in severe reputational and financial damage, such as being accused of greenwashing. So, just because there aren’t any direct penalties for non-compliance, don't risk it.

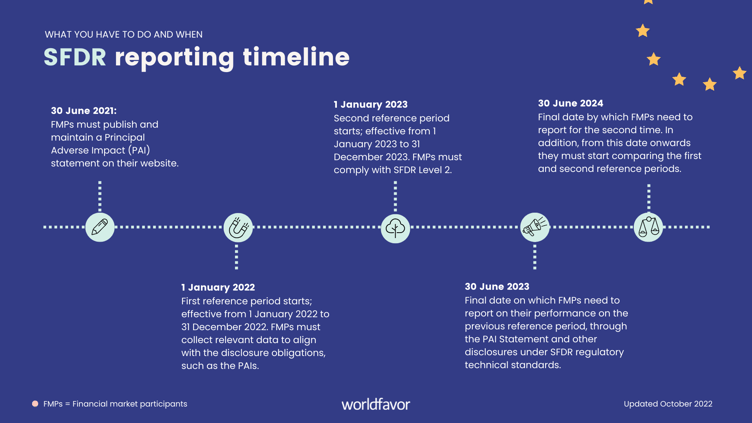

4. SFDR reporting timeline: what to disclose and when?

30 June 2021: The first date that FMPs had to publish and maintain a Principal Adverse Impact (PAI) statement on their websites.

1 January 2022: The first reference period starts; effective from 1 January 2022 to 31 December 2022. FMPs collect relevant data to align with the disclosure obligations, such as the PAIs, for the first time.

1 January 2023: The second reference period starts and is effective from 1 January 2023 to 31 December 2023. With the Level 2 phase enacted, compiling with the SFDR disclosure requirements becomes mandatory.

30 June 2023: The final date on which FMPs need to report their performance on the previous reference period through the PAI Statement and other disclosures under SFDR regulatory technical standards.

30 June 2024: The final date by which FMPs must report for the second time. Plus, from this date onwards, they must start comparing the first and second reference periods.

Learn more about the important dates of SFDR timeline in our blog "SFDR reporting timeline: what you have to disclose and when."

5. What is the difference between articles 6, 8, and 9 funds?

The difference between article 6, 8, and 9 funds is their sustainability level:Article 6: Funds without a sustainability scope.

Article 8: Funds that promote environmental or social characteristics (also known as light green).

Article 9: Funds with sustainable investment as their objective (also known as dark green).

To dig deeper into the difference between the funds, don’t miss out on our blog “SFDR: What is article 6, 8 and 9?” since it covers the funds in detail.

6. How does the EU Taxonomy relate to the SFDR?

The EU Taxonomy relates directly with the SFDR as it requires firms to disclose whether and to what extent products qualify as sustainable under the EU Taxonomy. Plus, the EU Taxonomy and the SFDR are both parts of the Green Deal – the EU’s strategy to channel money towards sustainable activities across the Union by increasing transparency and providing tools for investors to identify sustainable investment opportunities.

However, there is no obligation for an SFDR article 8 or 9 funds to invest in Taxonomy-aligned, environmentally sustainable investments. In other words, article 8 or 9 funds may qualify their investments as environmentally sustainable even if they are outside the Taxonomy's scope. These could be brown-green investments (made to qualify them as environmentally sustainable in the future) or non-EU investments (can’t meet the strict criteria in the Taxonomy for doing no significant harm).

So, even though the Taxonomy helps to define what is environmentally sustainable, you can be both 8 or 9 even though you are investing in things that are not Taxonomy-aligned.

7. What are the most common challenges of SFDR alignment?

Three common challenges of SFDR-alignment include (1) different interpretations of the regulation; (2) FMPs lacking the necessary data; and (3) the challenge of aligning with different requirements around the world:

- Interpretation: In-scope firms are uncertain how to interpret the SFDR. Problems can occur if people understand guidance documents presented by the EU differently.

- Lack of data: Firms might lack the necessary data, particularly from their portfolio companies, thus making it hard to follow the regulation. There are requirements to report on the emission volume of investee companies from January 2023 – scope 1, 2, and 3 emissions. If FMPs don’t have the data and the information to support article 8 and 9 funds, the regulation may become hard to follow – since failing to comply may impose additional risk.

- Lack of consistent disclosure requirements amongst ESG requirements globally": The difference between ESG disclosure requirements in different parts of the world and regulations may make it hard to align your goals as an organization with different sets of requirements and ensure that your reporting checks all the boxes.

8. And lastly, how to prepare for the SFDR?

Prepare your company by taking the following steps to easier align with the SFDR:

1. Figure out who needs to be on your team

Figure out who needs to be on your team to complete this. HR or other people within finance should be involved since the SFDR requires companies to report on 14 different sustainability factors and only six concerns emissions. Who do you need internally and externally from your portfolio companies?

2. Find out what disclosure requirements apply to your business

Take a good look at the RTS and figure out which templates apply to you. This way, you can start building your own timeline to customize it to your business.

3. Find a suiting data-sourcing method

Explore how you will source and follow up on your SFDR data to make your process run smoothly. Many FMPs are using sustainability software or platforms to streamline their SFDR process.

Learn how to collect, manage and report your SFDR data with Worldfavor!

4. Update your website

Keep your website updated, as well as other outward and inward-facing documents, to ensure they reflect what you are trying to say.

5. Keep up with the industry

Make sure you have the right resources available and stay on top of the regulatory developments related to the SFDR and the EU taxonomy.

Watch the webinar here:

Collect, manage and report your SFDR data in Worldfavor

Did you know that you can use Worldfavor to collect your SFDR data? Our Sustainable Investments solution is the fastest and easiest way to collect, calculate and aggregate all the data you need to increase your transparency and get ready to report on time. Are you ready to track and boost your portfolio companies' ESG performance today? Book a demo and get a customized platform tour with a team member, showing you what Worldfavor looks like in action.

Lastly, we want to thank Jillian C. Kirn for taking part in our webinar and sharing some of her expertise, insights, and SFDR tips with us. Check out Climate Change Counsel and their work here!

Related blog posts you might like:

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)