What is the EU Taxonomy?

Halfway through 2018, The European Commission established a Technical Expert Group (TEG) on sustainable finance to advise on a number of policy reforms. The aim was to help facilitate compliance with the Paris Agreement climate targets and the EU's commitment to adopt the UN’s Sustainable Development Goals (SDGs), as presented in the UN’s 2030 Agenda for Sustainable Development. On June 18, 2020 the EU Taxonomy Regulation was made official, starting a new era of sustainable financial regulations.

But what is the EU Taxonomy, exactly? The framework may seem overwhelming, which is why we have broken it down into a short and digestible guide, covering the EU Taxonomy on a basic level, and summarizing the most important key takeaways of the framework.

What is the EU Taxonomy?

The European Commission describes the EU Taxonomy as; “a tool to help investors, companies, issuers and project promoters navigate the transition to a low-carbon, resilient and resource-efficient economy”.

More specifically, the taxonomy is a regulatory classification system, helps companies to define which of their economic activities are environmentally sustainable. The EU Taxonomy makes it possible to define the environmental performance of several economic activities across a range of industries and states requirements corporate activities must meet to be considered sustainable from an environmental perspective. Also, the regulation requires some companies to report on their business activities to make sure they are aligned with the Taxonomy’s definition of sustainable. One could say that the EU Taxonomy is the EU's answer to “what is green?”, helping the market to gain a greater clarity when implementing sustainable measures.

"The EU Taxonomy is the EU's answer to “what is green?”, helping the market to gain a greater clarity when implementing sustainable measures."

The EU Taxonomy consists of a 600-page document including recommendations on taxonomy design as well as information about who has to do what and by when. There is also a shorter 67-page summary available. Note that the document is extensive, hoping to build toward improved environmental performance. Subsequently, the EU Taxonomy will entail more extensive reporting requirements for organizations that are affected by the law.

The EU Taxonomy Explained by PRI.

Who is affected by the EU Taxonomy?

The EU Taxonomy points out three groups of main taxonomy users:

- Financial market participants, offering financial products and services within the EU, including occupational pension providers.

- Large companies who are required to provide a non-financial statement, according to the Non-Financial Reporting Directive.

- The EU and Member States, when establishing public measures, standards or labels for green financial products or green bonds.

Although the EU Taxonomy focuses on sustainable finance, the scope is larger than that, stretching far beyond banking and other financial services in the long run.

What is the purpose of the EU Taxonomy?

The purpose of the EU Taxonomy is simply to help companies, project promoters and issuers to improve their environmental performance by presenting performance thresholds to help identify which activities are sustainable, and which are not. By establishing a list of common rules defining what a green investment is, the EU wants to make sure that money is being spent on truly sustainable activities.

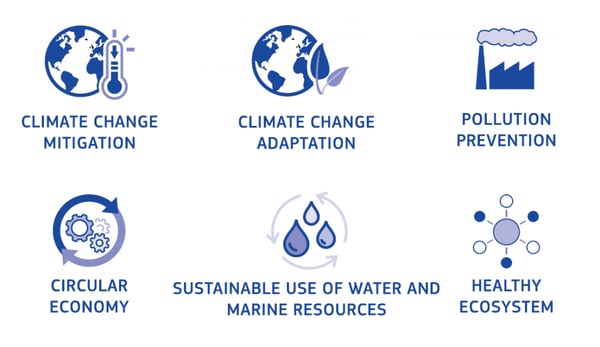

The six Taxonomy environmental objectives.

The six Taxonomy environmental objectives.

The aim is to achieve targets of net-zero carbon by 2050, and reducing all emissions by 50% by 2030. These are targets established by the Paris Agreement and the EU's commitment to adopt the UN’s Sustainable Development Goals (SDGs), as presented in the UN’s 2030 Agenda for Sustainable Development. Establishing an environment classification system is critical in order to meet these climate agreement deadlines.

How to comply with the EU Taxonomy

The EU has set three performance thresholds to ensure that activities are consistent with the environmental objectives. These thresholds are;

The EU has set three performance thresholds to ensure that activities are consistent with the environmental objectives. These thresholds are;

- Make a substantive contribution to one of six environmental objectives

- Climate change mitigation

- Climate change adaptation

- Sustainable and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

- Do no significant harm (DNSH) to the other five, where relevant

- Meet minimum safeguards

- For example; OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

In order to catch up with the EU Taxonomy and its performance thresholds, companies will need to figure out what data they need, how to analyze the data, and last but not least – how to report on it. The EU Taxonomy in practice implicates a more complex reporting process that requires companies to truly understand what they need to achieve in terms of reporting. Companies also need to think about what effect the new requirements will have on their marketing as well as their broader investment strategies. Further, companies need to identify needs such as resources, data, system, personnel and subject matter expertise, in order to meet the established requirements.

The new EU measures will have an enormous impact, not only within the EU, but reaching far beyond the European Union. The EU Taxonomy will be affecting the broader financial regulatory arena, shaping the flow of investments as well as the practice of a range of financial professions.

Align your organization with the EU Taxonomy

Is your organization affected by the legal requirements of the EU Taxonomy but you don’t know where to start? Worldfavor is the fastest and easiest way to future-proof your organization, assess EU Taxonomy alignment and gain insight on required actions. Book a demo today to find out more.

Related blog posts you might like:

- 5 Sustainability Reporting Frameworks to Help Your Organization Set Priorities

- More Businesses Needs to Repprt Their Climate Impact, Here’s why

- What are the GRI Standards?

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)