Sustainable Investments: What do Investors Look for in a Business?

Can one attract investors by putting in the work with sustainability? According to a recent study by PwC, 83% of limited partners and general partners believe that being better at managing ESG factors will either improve returns or reduce risk, making sustainable investments a good deal.

What is Sustainable Investments?

Sustainable investments is capital that are invested in companies that seek to improve ESG performance. The investors consider the ESG criteria to generate long-term competitive financial returns and positive societal impact.

What is ESG? ESG is a term that often is used synonymously with sustainable investment and stands for Environmental, Social, and Governance – areas that characterize sustainable investments. The term is mostly used by investors to evaluate corporations. The Financial Times Lexicon defines it as “a generic term used in capital markets and used by investors to evaluate corporate behaviour and to determine the future financial performance of companies.”

Sustainable investments is invested capital directed to companies that work with improving ESG performance. The latest research shows that investors care more about sustainability than business executives are currently communicating. However, there is still work to be done in quantifying climate-related financial information. Check out our overview of what investors prioritize and how businesses can mitigate a mismatch between investors’ interest and executive communication.

What ESG factors do investors care about most?

When making a sustainable investment, investors want to evaluate how well the company performs in each aspect of ESG. Though every aspect of ESG plays a critical role in improving the sustainability and long-term valuation of a company, according to a recent article by Greenbiz, investors are most interested in risk and good governance. These areas contribute to lower-risk and longer-term value creation. In addition and unsurprisingly, investors care most about how sustainable growth improves financial performance when making an investment. Therefore, companies that a.) communicate their ESGs in relation to material risks and government systems with b.) quantifiable insights on how their sustainability strategy saves costs, expands market share, and drives revenue growth are most likely to attract investors’ attention.

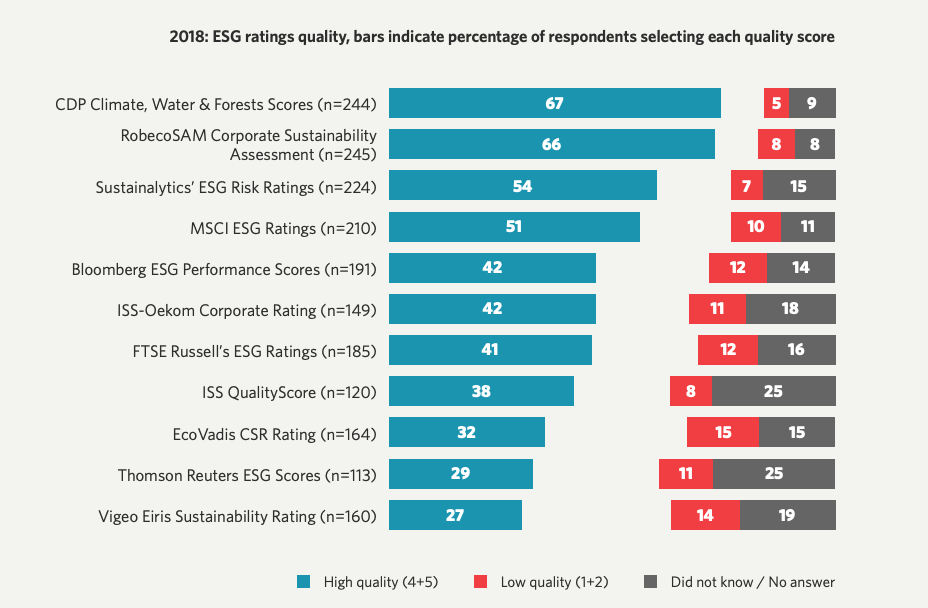

Another aspect of sustainable investments that investors take into account is how highly a company ranks on specific ESG ratings. According to SustainAbility’s report, CDP and RobecoSAM were perceived to have the highest quality ratings in relation to ESGs. This means investors check how companies rank according to these ratings in order to determine how attractive a company is from an ESG perspective and whether it's truly a sustainable investment or not. Check out how other ratings ranked in terms of quality, and thus, popularity:

The graph above shows which ESG ratings are most highly rated for their quality (blue) according to respondents. Source: SustainAbility

Quantifying sustainable investments is still difficult

Though investors desire – and often require – quantifiable sustainability information in order to better analyze the impacts and risks involved when making a sustainable investment, there is still a lack of tools and frameworks needed to comprehensively achieve this. In order to battle this challenge and enhance organizations' disclosures regarding climate-related information, the Task Force on Climate-related Financial Disclosures (TCFD) is developing a set of recommendations in order to standardize climate-related financial risk disclosures. Not only does this help investors better understand and benchmark a company's climate impact, but can increase a company's valuation by decreasing the amount of unknown risk, thus making them an attractive sustainable investment.

Currently, there is also the challenge in quantifying ESG programs’ link to stock returns. As Jane Ambachtsheer, Partner and Chair– Responsible Investment at Mercer says, "consistent, comparable, widespread disclosure on climate-related issues is not widely available, it's not widely discussed, and it needs to be." This is why TCFD is growing in popularity and necessity, especially in helping companies understand the impact the climate has on material operations and defining sustainable investments. In the near future, these kinds of frameworks will inform investors and stakeholders when making critical decisions regarding valuation and investment.

How businesses can remedy the mismatch between investor interest and business focus

In a recent survey by Bank of America Merrill Lynch, U.S. executives underestimated the percentage of their company’s shares held by firms employing sustainable investing strategies. The average estimate was 5%; the actual percentage is closer to 25%.

A reason for this may lie in the fact that the link between sustainability and value creation is still difficult to quantify because of a lack of standardization. However, statistics from BCG reveal that while 75% of investors see sustainability performance as relevant to their investment decisions, only 60% of business executives think investors care about sustainability. Because of this, many companies are missing out on a golden opportunity: to communicate the value proposition of their sustainability strategy to key stakeholders who may be looking for a sustainable investment. The more effectively businesses develop a sustainability strategy that is tightly woven into a business’ core impact – and talk about it – the more they will benefit from long-term value creation, which sparks investors’ interest. Additionally, businesses that look into which areas rating firms evaluate companies on when considering a sustainable investment is a strategic move – ranking highly in these particular practices will gain investor traction.

Lastly, financial performance of ESG factors is most effectively communicated to investors by C-level executives and board members. Though sustainability managers need to be part of discussions, investors desire conversation with top-level executives since they are responsible for the financial returns and core business strategy of the company as a whole. If C-level executives are talking about it, investors are more convinced of the business’ commitment to ESG factors and financial performance, making it an attractive sustainable investment.

Want to learn more about investing in sustainable business? Book a demo to check out our Sustainable Investment Solution.

Related blog posts you might like:

- Why Sustainable Risk Assessment is Crucial for Enterprises to Thrive

- Sustainability as a Part of Core Business

- 5 Frameworks to Tackle ESG Factors in the Financial Sector

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)