The TCFD and the UK's Mandatory Climate Risk Disclosure

What is the TCFD?

The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015 by the G20 Financial Stability Board (FSB) to “develop voluntary, consistent climate-related financial disclosures that would be useful to investors, lenders and insurance underwriters in understanding material risks”. The TCFD is committed to creating transparency and stability in the financial market, believing that with transparent information companies are able to better integrate climate-related risks and opportunities in their risk management processes.

In 2019, the UK government asked regulators and various departments to explore the most effective approach in terms of implementing the recommendations of the TCFD. They have now come up with an answer.

In November 2020, the Treasury published an Interim Report based on their findings, along with a roadmap focused towards mandatory climate-related disclosures. The regulators have decided that voluntary methods have failed to produce sufficient results so far, which is the main reason for the change in tack.

The requirements of the TCFD and Mandatory Climate Disclosure

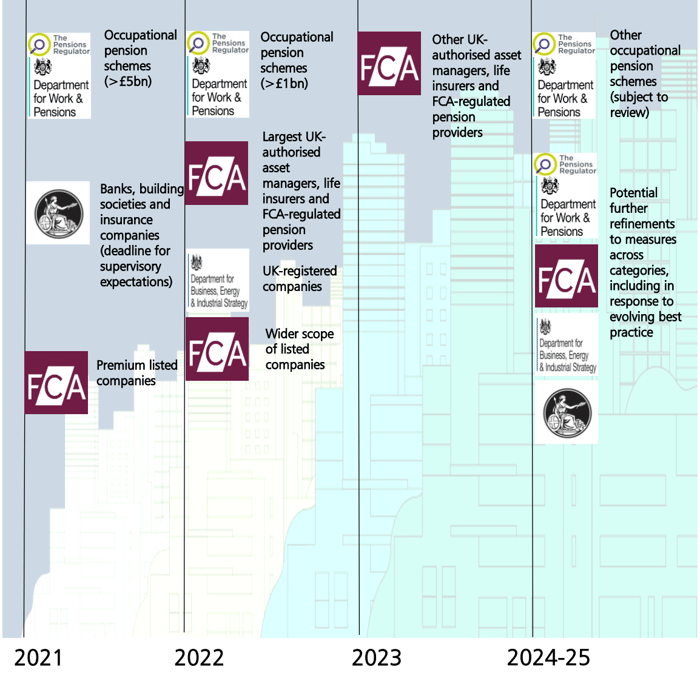

To date, companies have been asked to transparently and consistently disclose their climate related risks, but only on a voluntary basis. The UK government has now decided to make TCFD-aligned disclosures mandatory across their economy by 2025, with a significant portion of these requirements set to be in place by 2023.

The seven categories of organisation identified by the interim report are as follows:

- UK listed commercial companies

- UK-registered large private companies

- Banks and building societies

- Insurance companies

- UK-authorised asset managers

- Life insurers and FCA-regulated pension schemes

- Occupational pension schemes

Businesses that fall under these categories will have to adhere to the new guidelines, with additional measures planned over the next five years.

One example is that coverage of disclosures could increase each year, as they aim for a coordinated approach. The report details their attempts to refine their methods, as well as to better assess the ‘risks and opportunities presented by rising temperatures, climate-related policy, and emerging technologies in our changing world’.

This is a massive shift from the current situation, but one that has been coming for a while given growing concerns about the climate.

What does TCFD-reporting and the Mandatory Climate Risk Disclosure mean for businesses and stakeholders?

Many businesses have already started to improve and increase their reporting of climate-related financial information to match consumer expectations in 2020. This can be in the form of better disclosure or more transparency, while they may have improved procedures to enact measurable change. For some sectors, these changes have already started to take effect.

The roadmap states that “initial steps to introduce TCFD-aligned disclosures have already been taken in respect of certain listed companies, banks and building societies, insurance companies and occupational pension schemes.”

They plan to build upon these initial steps, using the Department for Business, Energy and Industrial Strategy (BEIS) to consult on measures for UK-registered companies.

For the average company operating in the UK, it is expected that they will need to report on climate-related policies and actions in a consistent manner, while disclosing information relating to sustainability.

The TCFD has made four recommendations for how businesses should keep investors informed of climate risks and opportunities. These are;

“describing management oversight of risks, explaining how their strategy would cope in different temperature scenarios, setting out risk management processes and reporting their progress against targets.”

The roadmap and timeline

As well as plans for the BEIS to consult on measures, the roadmap itself sets out the pathway for fulfilling the new mandatory requirements. The roadmap lists the following timeline of planned or potential regulatory actions or legislative measures over the next five years:

As you can see from the infographic above, there is a lot of potential scope for the legislative guidelines. Evolving best practices also make sense as they refine the measures, allowing for more clarity with all parties involved.

It’s a short time frame, with incremental steps expected for each year. As UK-listed commercial companies and UK-registered large private companies are both affected, it’s important to check whether your company falls under their remit.

Indications: what alignment will entail

In their own words, the guidelines will set out an ‘indicative path towards mandatory climate-related disclosures across the UK economy aligned with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)’.

The scope of their remit is yet to be decided, and the UK government will provide an update on their progress so far in the 2022 refresh of the Green Finance Strategy.

The interim report also “strongly supports the International Financial Reporting Standards (IFRS) Foundation’s proposal to create a new, global Sustainability Standards Board, as well as complementary work underway on harmonization by an alliance of voluntary standard-setting organisations.”

This would help in terms of streamlining the process, ensuring that there is an agreed upon set of standards which can be used to hold companies and businesses accountable when they report on climate disclosures.

For companies that do have their main listing in London, climate-related disclosures look to be unavoidable. The alternative means explaining why you haven’t done so to the TCFD, who are likely to be unimpressed with most excuses.

The changes signify another paradigm shift in terms of the relationship between business and the environment. For the companies affected, they will be better insulated against risks associated with climate-related issues. As a society, we will all benefit from improvements to climate disclosure, so there are clear winners all round.

As such, we can expect climate-related disclosure to become more important over the next decade, helping to fall in line with targets set by Agenda 2030.

Managing supply chain sustainability at medium-to-large enterprises is not an easy task – and when you factor in multiple tiers of suppliers, this task gets even harder! Let us walk you through how to achieve transparency in a multi-tier supply chain in this 20-minute webinar, watch it now:

Related Blog Posts:

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)