SFDR: What are the PAI indicators?

Reporting on the PAI indicators is widely considered the trickiest aspect of SFDR reporting. Although the EU-wide regulation is fully in force, investors are still left scratching their heads trying to figure out exactly what’s needed to comply.

In this blog, we’ll break down all the PAI indicators – and for some more hands-on help, download our free step-by-step guide to SFDR compliance here:

Published: February 2023

The Sustainable Finance Disclosure Regulation (SFDR) is the EU regulation aiming to regulate sustainable investments – making it mandatory for all financial market participants (FMPs) such as banks, investment firms, and pension funds, to disclose the negative impact their financial products have on the people and planet in a standardized format.

One of its requirements is for FMPs to report on a set of principal adverse impact indicators, also known as the PAIs. While reporting on the PAIs is a big step in standardizing ESG reporting, enabling transparency, and fighting greenwashing – they’re also widely considered the most challenging aspect of SFDR.

So to all investors out there trying to come to grips with the principal adverse impacts of SFDR – this one's for you.

What are principal adverse impacts?

Principle Adverse Impacts (or PAI) is a concept developed to better display negative impacts investments have on various sustainability factors. This way, the market will better understand how a potential investment, portfolio, or financial product impacts the planet and people.

To report on the principal adverse impacts, companies must score the sustainability of their investments based on a set of adverse impact indicators called the PAI indicators. These indicators consist of 14 mandatory and 31 voluntary indicators focusing on environmental and employee matters, respect for human rights, and anti-corruption and anti-bribery matters. Investors must report on all 14 core indicators, plus choose at least two additional (at least one climate and environmental-related and one social and employee-related).

What are the mandatory PAI indicators?

| Climate and other environment-related indicators: | Social and employee matters, respect for human rights, anti-corruption and anti-bribery matters: |

| GHG emissions (Scope 1, 2, and 3, and total GHG emissions) | Violations of UN Global Compact Principles and Organizations for Economic Cooperation and Development (OECD) guidelines for multinational enterprises |

| GHG intensity of investee companies | Lack of processes and compliance mechanisms to monitor compliance with UN Global Compact Principles and OECD Guidelines for Multinational Enterprises |

| Share of investment in companies active in the fossil fuel sector | Unadjusted general pay gap |

| Share on non-renewable energy consumption and production | Board gender diversity |

| Energy consumption intensity per high-impact climate sector | Exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons, and biological weapons) |

| Activities negatively affecting biodiversity - sensitive areas | |

| Emissions to water | |

| Hazardous waste ratio |

What are the voluntary PAI indicators?

| Climate and other environment-related indicators: | Social and employee matters, respect for human rights, anti-corruption and anti-bribery matters: |

| Emissions of inorganic pollutants | Investments in companies without workplace accident prevention policies |

| Emissions of air pollutants | Rate of accidents |

| Emissions of ozone depletion substances | Lack of supplier code of conduct |

| Investments in companies without carbon emission reduction initiatives | Lack of grievance/complaints handling mechanism related to employee matters |

| Breakdown of energy consumption by type of non-renewable sources of energy | Insufficient whistleblower protection (policy) |

| Water usage and recycling | Incidents of discrimination |

| Investments in companies without water management policies | Excessive CEO pay ratio |

| Exposure to areas of high water stress | Lack of human rights policy |

| Investments in companies producing chemicals | Lack of due diligence |

| Land degradation, desertification, soil sealing | Lack of processes and measures for preventing trafficking in human beings |

| Investments in companies without sustainable land/agriculture practices | Operations and suppliers at significant risk of incidents of child labor |

| Investments in companies without sustainable ocean/seas practices | Operations and suppliers at significant risk of incidents of forced or compulsory labor |

| Non-recycled waste ratio | Number of identified cases of severe human rights issues and incidents |

| Natural (threatened) species and protected areas | Lack of anti-corruption and anti-bribery policies |

| Deforestation | Cases of insufficient action taken to address breaches of standards of anti-corruption and anti-bribery |

| Share of securities not certified as green under a future EU legal act setting up an EU Green Bond Standard | Number of convictions and amount of fines for violation of anti-corruption and anti-bribery laws |

What is a PAI statement? And what must be disclosed?

According to Article 4 of SFDR, FMPs are obligated to publish and maintain certain information on their principal adverse impacts on their website through their PAI statement.

PAI statement checklist:

- Information about the policies on the identification and prioritization of principal adverse sustainability impacts and indicators

- The 14 mandatory indicators plus the two additional indicator

- A description of the PAIs, and taken or planned actions to manage them

- A statement on due diligence policies in place

- Over time: the PAI Statement must also include historical comparisons covering up to five reference periods against the current reference period.

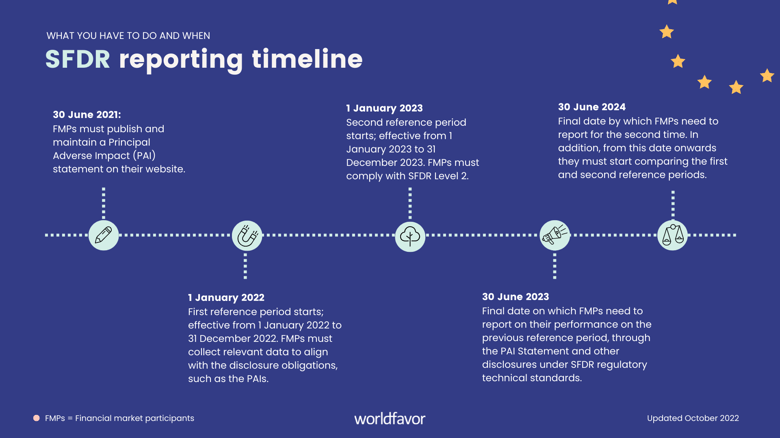

When must the PAI statement be disclosed?

The PAI statement must be published on the FMPs webpage before June 30th each year, covering a reference period between January 1st and December 31st.

And don’t wait until the last minute to report – even if that's an easy trap to fall into. Investors should start collecting and calculating the data well ahead of the deadline, as the process involves coordination and cooperation with several stakeholders.

Who has to disclose?

The SFDR regulation targets asset managers, not individual funds or portfolio companies. So the PAI statement must disclose the PAI scores on the fund level. This means it’s in the manager’s best interest to work out a way to engage with portfolio companies to start reporting and sharing the information needed to present findings on portfolio level.

Still wondering how to access the data you need?

While investors are doing their best to collect, aggregate, and make sense of the data they need to fulfill the SFDR’s regulatory compliance, they usually lack access to their portfolio’s data. The easiest way is to grant your portfolio companies the tools, means, and guidance necessary to make the data-sharing process as smooth and straightforward as possible.

SFDR reporting made easy with Worldfavor

Worldfavor offers complete guidance and support for investors in SFDR alignment. We help you set your scope, collect key data, and generate your PAI statement with a click of a button. Meanwhile, we support your portfolio companies in what and how to report their data, so you get your hands on relevant data in the right format. Want to know more? Get in touch with us today!

Related blog posts you might like:

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)