IFRS S1 and IFRS S2 explained

Starting in January 2024, the International Sustainability Standards Board (ISSB) implemented its first two standards: IFRS S1 and IFRS S2. Developed to meet investors’ demand for sustainability information, while simultaneously help companies provide a comprehensive overview of their sustainability efforts.

Published: January 2023

In 2022, the IFRS Foundation introduced its new board: the International Sustainability Standards Board (ISSB). The ISSB was put together to create global sustainability standards to improve the quality and consistency of sustainable disclosure worldwide.

This marked the beginning of a new era many have been waiting for, an era where sustainability reporting is set to be understood, structured, and scrutinized the same as financial reporting.

In 2023, the ISSB released its two first standards: the IFRSS 1 and IFRS S2, which are set to take effect from January 1, 2024 and onwards.

In this blog, we’ll look into what the IFRS S1 and S2 cover, explore which countries are adopting them, and how the introduction of these standards will affect companies in the EU.

IFRS S1: General requirements for disclosure of sustainability-related financial information

IFRS S1 covers all essential information on how a company governs its sustainability-related financial risks and opportunities. These risks and opportunities are related to activities that can impact the business, including aspects such as cash flows, ability to get funding, and value chain resources and relations.

IFRS S1 requires the company to provide information about:

- its processes and procedures for monitoring, managing, and overseeing its sustainability-related risks and opportunities

- its strategy for managing sustainability-related risks and opportunities

- the identification, assessment and prioritization processes of sustainability-related risks and opportunities; and

- its performance, including progress towards targets the entity has set or is required to meet by law or regulation, in relation to sustainability-related risks and opportunities.

IFRS S2: Climate-related disclosures

IFRS S2 covers all essential information about a company’s climate-related risks (both physical and transitional risks*) and opportunities that can impact their business, including aspects such as cash flows, ability to get funding, and cost of capital, in the short, medium, and long run.

IFRS S2 requires the company to provide information about:

- its strategy for managing climate-related risks and opportunities;

- the identification, assessment and prioritization processes of climate-related risks and opportunities. This involves discoloring about whether and how these processes are integrated into the company’s overall risk management. and;

- its performance, including progress towards any climate-related targets it has set, and any target it’s required to meet by law or regulation.

*Physical risks refer to risks and damage resulting from climate-related events such as extreme weather conditions, including floods, storms, and wildfires. Transitional risks result from changing regulations and policy actions taken to shift the economy away from fossil fuels.

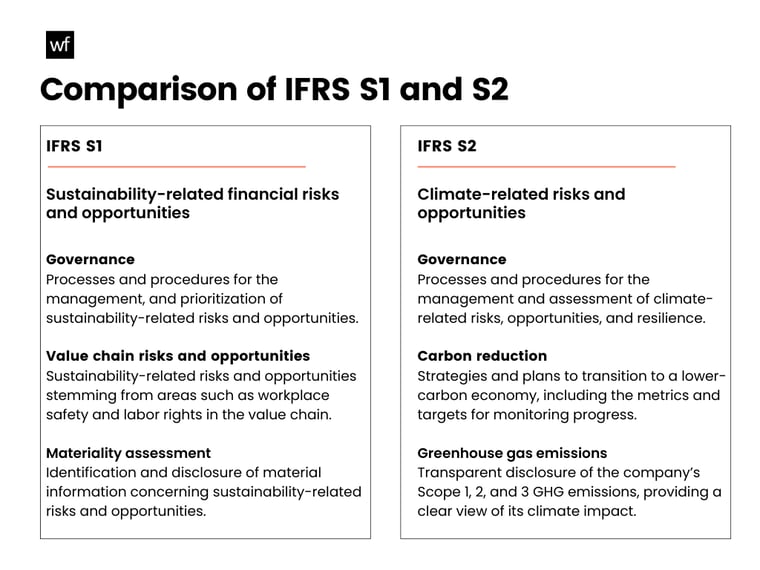

Comparison of IFRS S1 and S2 reporting requirements.

Countries adopting the ISSB’s standards

As the IFRS S1 and S2 are now finalized, it’s now the governments' responsibility to incorporate these standards into their regulatory framework by 2025. Australia, Japan, and the UK have announced that they’ll adopt the standards, while several other major countries, including Canada, New Zealand, Nigeria, Singapore, and Malaysia, have shown interest.

As you might’ve noticed, no EU member countries are on the list. The reason is that the EU has introduced its own mandatory sustainability standards, the European Sustainability Reporting Standards (ESRS) as part of the EU’s green deal.

Even with its own set of standards, the EU has made it clear that the ESRS and IFRS are highly aligned with one another. In fact, ESRS and the IFRS S1 and S2 were developed in parallel, making it easier for companies to comply with both sets of standards.

Simplify ESG reporting with Worldfavor

Use Worldfavor’s platform to track your ESG performance, access actual data from suppliers, and uncover hidden risks and opportunities. Say goodbye to compliance headaches – our extensive standard library has you covered for IFRS, ESRS, and more.

Want to know more? Book a free demo today!

Related blog posts you might like:

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)