CSRD: what is the double materiality assessment?

If you're affected by the EU's Corporate Sustainability Reporting Directive (CSRD), you'll need to conduct a double materiality assessment. Not sure what that is? No worries, in this blog, we'll go over what it means and how to do it.

Does the CSRD apply to you? Get your own Worldfavor CSRD guide for free:

Published: July 2023

Right now, there’s a total buzz around the concept of “double materiality” in the corporate sustainability world, and for good reasons:

Carrying out a double materiality assessment is actually the essential first step to comply with the EU’s new Corporate Sustainability Reporting Directive (CSRD), which kicks in January 2024 already.

In other words: understanding what double materiality is and how to apply it within your company has never been more important.

To help you make sense of it all, we've created this blog. Find out what a double materiality assessment is along with the necessary steps to comply with the CSRD.

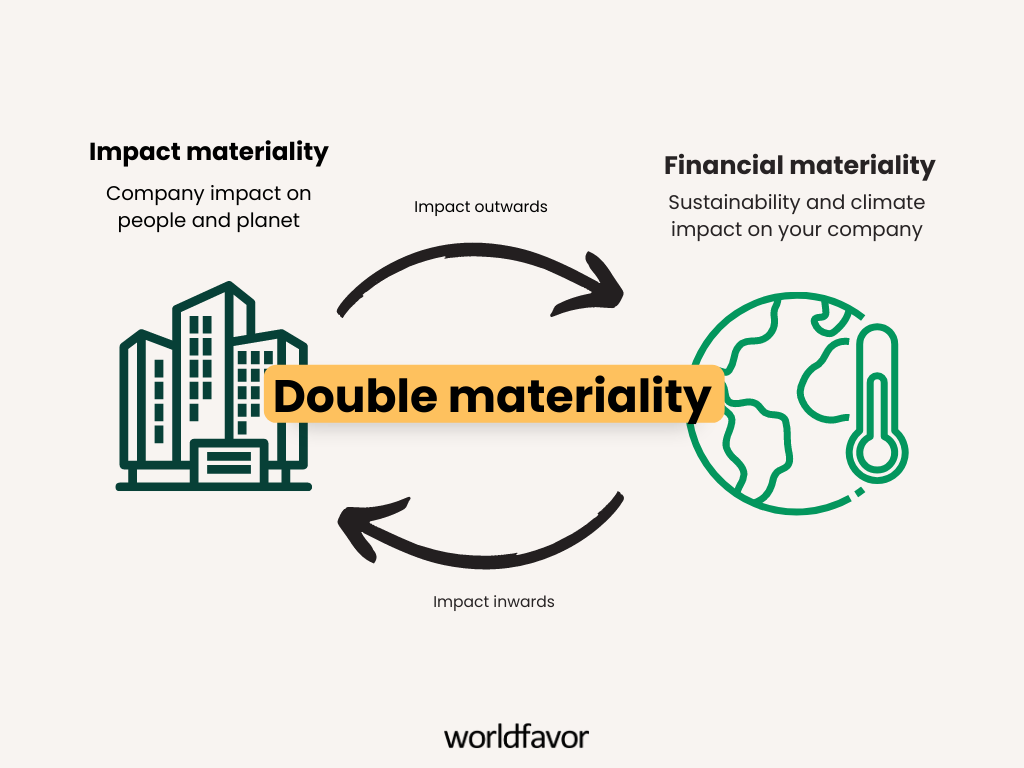

What is double materiality?

Double materiality is a concept in which companies must consider how their actions impact both people and the planet, but also how sustainability issues can affect their financial-wellbeing. It’s basically about looking at the big picture from two different angles.

What is the CSRD’s double materiality assessment?

Carrying out a double materiality assessment is the essential first step towards achieving CSRD compliance, as it enables in-scope companies to identify which disclosure requirements listed in the European Sustainability Reporting Standards (ESRS) are relevant to them.

The ESRS set out long lists of sustainability topics companies should report on. The specific topics relevant to your company and requiring reporting will be determined through the double materiality assessment.

Think of it this way: the double materiality assessment ensures that the company's sustainability reports focus on the topics that are truly relevant for them, and not just cherry-pick what suits them.

Is double materiality mandatory?

Yes, for companies affected by the CSRD, conducting a double materiality assessment is mandatory. This standardized process helps them determine which sustainability issues are material and should be included in their reporting.

Impact and financial materiality

There are two types of materiality that companies need to consider when carrying out their double materiality assessment according to the CSRD:

1. Impact materiality

All about how your company’s actions impact people and the planet in the short, medium, and long term. And remember, it’s not just about your own operation; you also need to assess the impact on your entire value chain.

2. Financial materiality

Here, the focus shifts to how sustainability and climate impact your business. This includes factors such as your company’s growth, performance, and cost of capital in the short, medium, and long term.

By combining these two factors, you can figure out which sustainability risks and opportunities are material for your company specifically and thus should be included in your reporting. It’s important to establish appropriate thresholds to help you make this decision, such as the likelihood of occurrence and the potential financial effect. This way, you can ensure that you include important information in your reports.

How to perform a double materiality assessment according to CSRD:

Performing a double materiality assessment according to the CSRD involves the following steps:

1. Connect with your stakeholders

Engage with relevant stakeholders to gather information about your organization's impact on the environment and society, as well as sustainability risks and opportunities. These stakeholders usually include your suppliers, partners, and various departments in your organization.

Stakeholder mapping can be a great start for identifying which groups should be involved in your assessment.

2. Identify and define your reporting topics

Determine which sustainability topics from the ESRS lists are relevant and material to your organization. Consider factors such as the sector's activities, locations of operation, and your entire value chain. Define these issues in terms of your impacts, risks, and opportunities.

3. Assess impact and financial risks and opportunities:

Once you’ve identified the relevant sustainability topics for your organization, it’s time to evaluate their impact, risks, and opportunities. This involves considering both their significance in terms of environmental and social impact (impact materiality), as well as their financial impact (financial materiality).

This step requires you to understand happening in your organization, in your value chain, and overall sustainable developments that can affect your business in various ways. For instance, what can be the risks, both financial and reputational, of human rights violations in your supply chain? Or can the EU’s new, robust nature restoration and climate laws potentially lead to increased taxes for your business?

4. Rank risks and gain an overview of potential challenges

Create visual representations, such as tables or materiality matrices, to present the identified risks and opportunities and their ranking. Make sure they're detailed enough to provide value while remaining easily understandable for all your stakeholder. But what's suitable for you depends on factors like the level of detail you want to present, as well as specific requirements or preferences of your stakeholders.

5. Show your plan forward

Last but not least: Communicate your actions planned to manage the environmental and societal impacts for each identified material sustainability topic. This includes disclosing metrics, targets, policies, and action plans. You should also account for the sustainability topics in your strategic planning, such as considering how they impact the business model, market position, and value chain.

Access, understand, and report ESG data with Worldfavor

Are you looking for a seamless solution for your CSRD tasks? Worldfavor's ESG platform enables companies to easily access, share and analyze ESG. Gain a better understanding of your organization's impact and supply chain. Simplify your ESG reporting process today. Book a demo now to discover more!

Related blog posts you might like:

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)