The EU Taxonomy: A summary

Updated: March 2022

In 2018, the European Commission established the EU Taxonomy: a new classification system of what will be considered environmentally sustainable economic activities in the future. While the EU Taxonomy has been highly welcomed by financial actors across the continent, its several updates and changes have created confusion of what to disclose and when. In our report State of sustainable investment 2021, we found that almost half of the participants have low or very low knowledge of the EU Taxonomy.

So, to help you navigate through the maze of new updates and deadlines, we have gathered all the new key dates and updates to keep an eye on. Keep reading this blog and become an EU Taxonomy expert once and for all!

What is the EU Taxonomy?

The EU taxonomy can be described as a classification system, which establishes a list of sustainable economic activities. In their own words; the EU Taxonomy “is a tool to help investors, companies, issuers and project promoters navigate the transition to a low-carbon, resilient and resource-efficient economy.” It should also help the market to have greater clarity when implementing sustainable measures.

How will the EU Taxonomy work in practice?

The EU taxonomy has a list of common rules to define what counts as a green investment to ensure that money is being spent on sustainable activities. They also want to stamp out the practice of ‘greenwashing’ in the financial sector, which companies use to trick the public into thinking that an organization's products, aims or policies are environmentally friendly.

For example, a company might switch to a more cost-effective method that just so happens to be greener, or misrepresent their emissions data, while reaping the PR benefits of the decision.

The Technical expert group on sustainable finance (TEG) takes the view that; “the trajectory of today’s economy is not consistent with the EU’s environmental goals. Few sectors of the economy are operating at a net-zero level, and emissions are not reducing fast enough. Few communities and businesses are systematically preparing for a changing climate.”

The following trio of thresholds are set out in the EU Taxonomy to ensure that activities are consistent with the environmental objectives;

- Make a substantive contribution to one of six environmental objectives;

- Climate change mitigation

- Climate change adaptation

- Sustainable and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

- Do no significant harm (DNSH) to the other five;

- Meet minimum safeguards (e.g., OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights)

Key takeaways from the EU Taxonomy

The EU Taxonomy is an extensive document which hopes to build towards improved environmental performance. Here are some of the key points to consider:

The recommendations relate to the design of the EU Taxonomy and include extensive implementation guidance for businesses that fall under their sphere of influence- While they focus on sustainable finance, their scope is much larger than banking and other financial services in the long-term

- To achieve targets set in the European Green Deal, they’re using the full force of the law at their disposal

- The report states that “the final Taxonomy Regulation introduces a new disclosure requirement for companies already required to provide a non-financial statement under the Non-Financial Reporting Directive”

- The TEG has added criteria for 67 economic activities which could contribute substantially to climate change mitigation

Final EU Taxonomy Report, PRI

New changes in the EU Taxonomy timeline

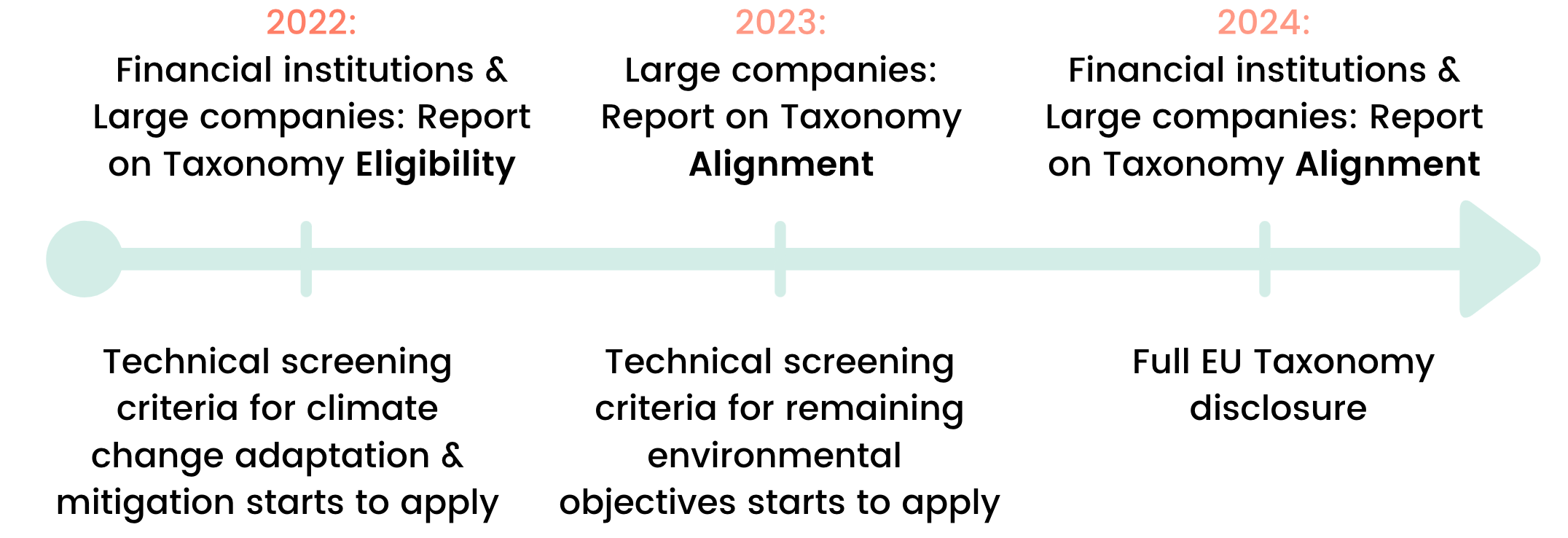

In July 2021, the EU Commission published the final version of the first Delegated Act – and there are some major changes from the previous versions to take note of. First, the timeline has been pushed out compared to the previous versions. Second, the first mandatory reporting, which is now in 2022, has been reduced to only report on the percentage of eligibility. Reporting on the alignment has been postponed to 2023 for companies covered by the NFDR (non-financial companies) and 2024 for Financial Institutions – allowing the market more time to prepare.

Want to dive deeper into the new changes of the EU Taxonomy? Make sure to check out our newly updated EU Taxonomy guide to get a more detailed overview of the EU Taxonomy and what is expected of you!

Align your organization with the EU Taxonomy

Is your organization affected by the legal requirements of the EU taxonomy but you don’t know where to start? Worldfavor is the fastest and easiest way to future-proof your organization, assess alignment and gain insight on required actions.Book a demo today to find out more.

Related blog posts you might like:

- 2019 CHRB Shows Most Businesses Failing on Human Rights

-

Sustainability through transparency in the wine and spirits industry

- An overview of corruption in supply chains

%20as%20the%20deadline%20approaches.%20Learn%20about%20compliance%20requirements%2c%20potential%20delays%2c%20and%20key%20updates..png)